wv estate tax return

There are two kinds of taxes owed by an estate. WV4868 Application for Extension of Time to File.

B Returns by personal representative.

. B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the tax commissioner. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. Tax Information and Assistance.

One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions. Select Popular Legal Forms Packages of Any Category.

Ad Personal ITR More Fillable Forms Register and Subscribe Now. Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the West Virginia estate tax. DNG-2 Downstream Natural Gas Manufacturing Investment Tax Credit Against Personal Income Tax.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Divisions primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. West Virginia Estate and Inheritance Tax Return Engagement Letter - 706 Get state-specific forms and documents on US Legal Forms the biggest online library of fillable legal templates available for you to download and print. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as.

Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return. When does the Estate Appear on the West Virginia State Tax Return When a person dies the estate state tax returns would appear on page 19 of the West Virginia State Tax Return. -- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article.

IT-140NRC West Virginia Nonresident Composite Return. Upload Modify or Create Forms. The gift tax return is due on April 15th following the year in which the gift is made.

-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. West Virginia has neither an estate tax a tax paid by the estate nor an inheritance tax a tax paid by a recipient of a gift from an estate. Estate tax returns.

However in addition to the federal gift estate and generation-skipping taxes some states. 2022 STC-1232-I Industrial Business Property Return. 304 558-3333 or 800 982-8297.

2023 Trend and Depreciation Trend and Percent Good Tables for Tax Year 2023. 110-CSR-1P Legislative Rule Title 110 Series 1P Valuation of Commercial and Industrial Real and Personal Property for Ad Valorem Property Tax Purposes. All Major Categories Covered.

A When no return required. Payment of Additional Estate Taxes in WV. Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the tax commissioner. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map.

-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal. A person does not have to file an individual return if he or she has an estate greater than 40000. Use e-Signature Secure Your Files.

Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the tax commissioner. Try it for Free Now.

Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. 31 rows Generally the estate tax return is due nine months after the date of death.

Property Tax Forms and Publications. We use cookies to improve security personalize the user experience enhance our marketing activities including. This page contains basic information to help you.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. -- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. For a calendar of property tax return due dates please click.

Tax Information and Assistance. The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. -- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article.

For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department.

Fillable Form Purchase Agreement Purchase Agreement Agreement Things To Sell

Real Estate Transfer Tax Return For Start Up Ny Leases Tp 584 Sny

Pennsylvania Quit Claim Deed Form Quites The Deed Nevada

Free West Virginia Tax Power Of Attorney Form Wv 2848 Pdf Eforms

Mailing A Tax Return To The Irs Or Your State

Maine Tax Forms And Instructions For 2021 Form 1040me

Top Five Tax Surprises With Multiple Jobs Overemployed

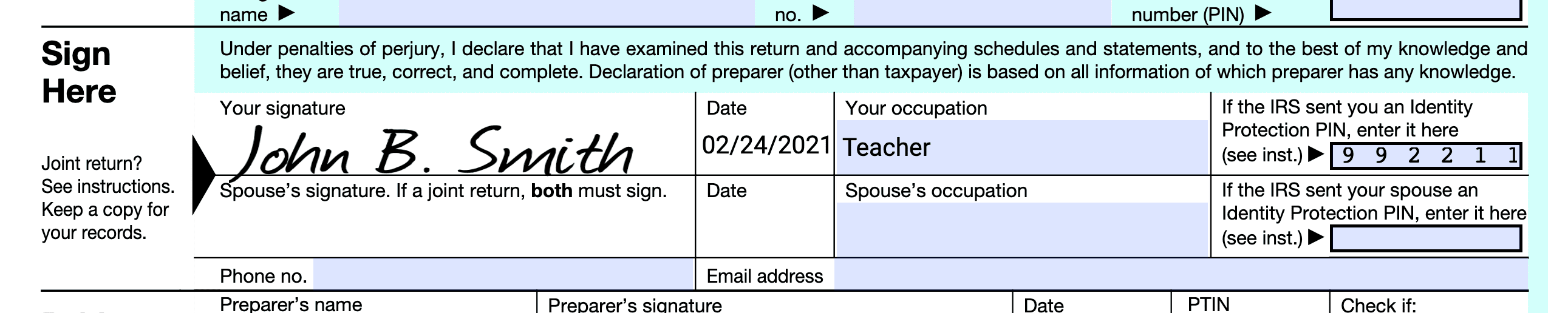

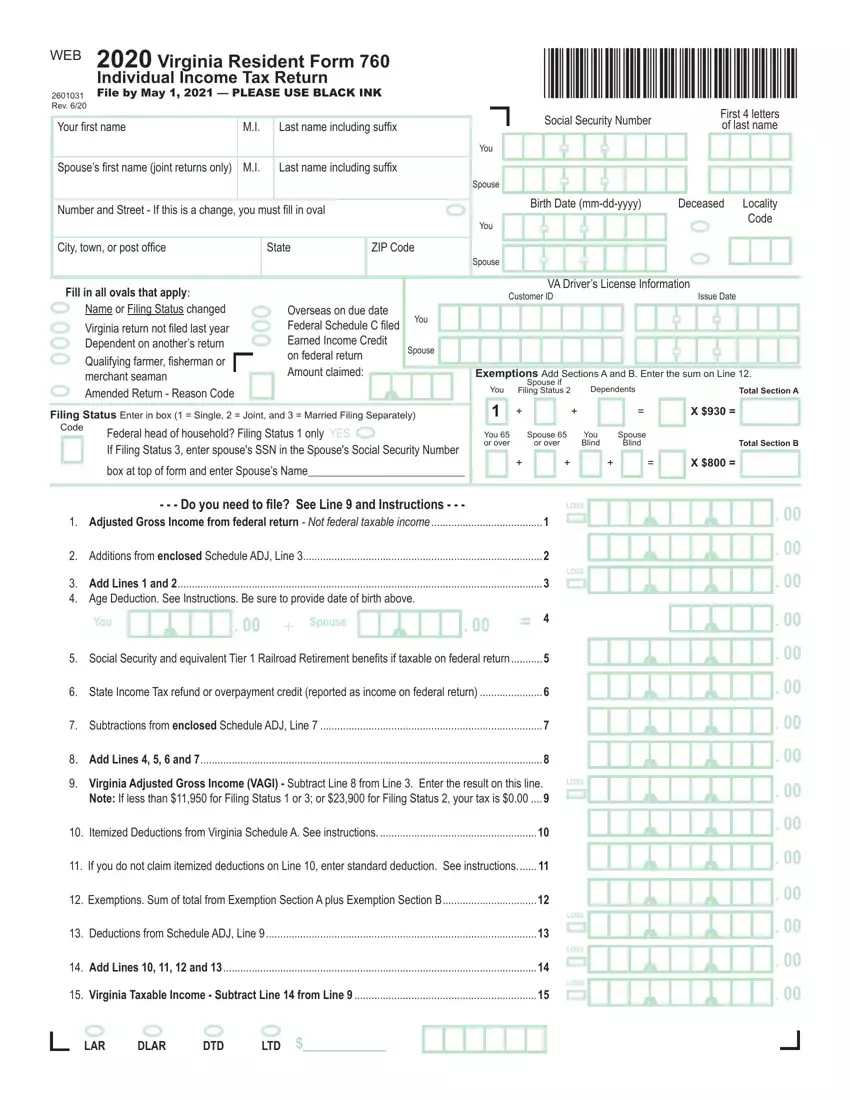

Virginia State Tax Return Form 760 Fill Out Printable Pdf Forms Online

Arizona Tax Forms 2021 Printable State Az Form 140 And Az Form 140 Instructions

Can You Keep Your Tax Refund After Filing Chapter 7 Or 13

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Request Attachments To Connecticut Estate Tax Return Pc 208 Pdf Fpdf Docx

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

Estate Tax Rates Forms For 2022 State By State Table

Earned Income Tax Credit Now Available To Seniors Without Dependents

Washington Dc Tax Forms And Instructions For 2021 Form D 40

3 11 16 Corporate Income Tax Returns Internal Revenue Service